Expectations Of Continued Monetary Tightening Support the Dollar.

Market News Summary

The minutes of the Federal Reserve’s meeting showed that officials expressed concerns about the pace of inflation in their previous meeting in July, stating that further interest rate hikes would be necessary in the future unless economic conditions change.

The meeting minutes stated, “With inflation continuing to run above the Federal Reserve’s target and labor market tightening persisting, a majority of participants see escalating inflation pressures that require further tightening of monetary policy.”

European stocks declined yesterday, Wednesday, due to the drop in bank stocks as mounting evidence of the Chinese economy losing momentum left investors worried. Meanwhile, British stocks faced pressures from increasing concerns about ongoing inflation.

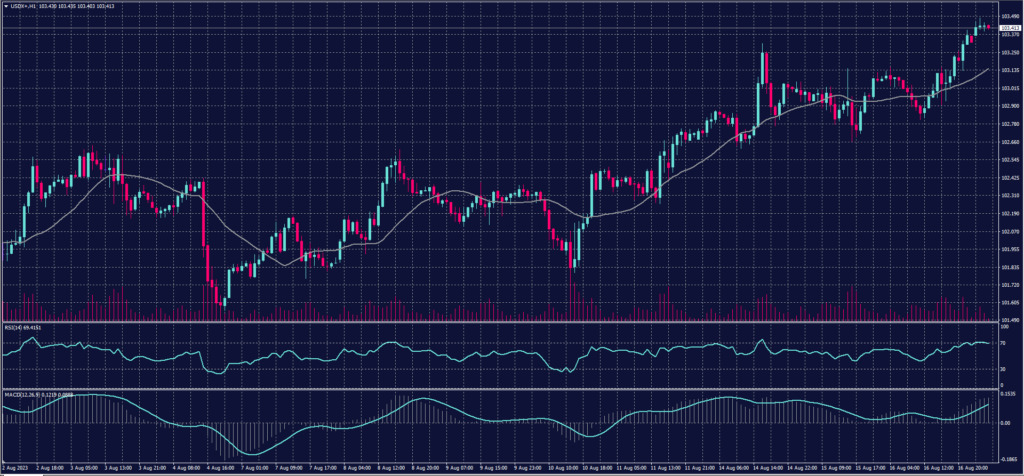

Dollar Index (USDX)

The dollar index rose and gained momentum following strong economic data in recent times, which bolstered expectations that the Federal Reserve will continue its monetary policy tightening.

Although a few members had indicated after the prior meeting that additional interest rate hikes might not be imperative, the minutes of the meeting unveiled a prevailing sense of caution among them. Throughout the deliberations, Federal Reserve members reaffirmed their dedication to upholding the course of monetary tightening until inflation gravitates back to the intended threshold of 2% gradually over time.

Pivot point: 103.15

| Resistance level | Support level |

| 103.55 | 102.95 |

| 103.75 | 102.55 |

| 104.15 | 102.35 |

Spot Gold (XAUUSD)

On Thursday, gold prices reached their lowest point in five months as the dollar strengthened and yields on U.S. Treasury bonds gained momentum in response to robust economic data.

The spot market price of gold reached $1891.70 per ounce, marking its lowest level since March 15th.

Pivot point: 1896

| Resistance level | Support level |

| 1901 | 1886 |

| 1912 | 1880 |

| 1917 | 1870 |

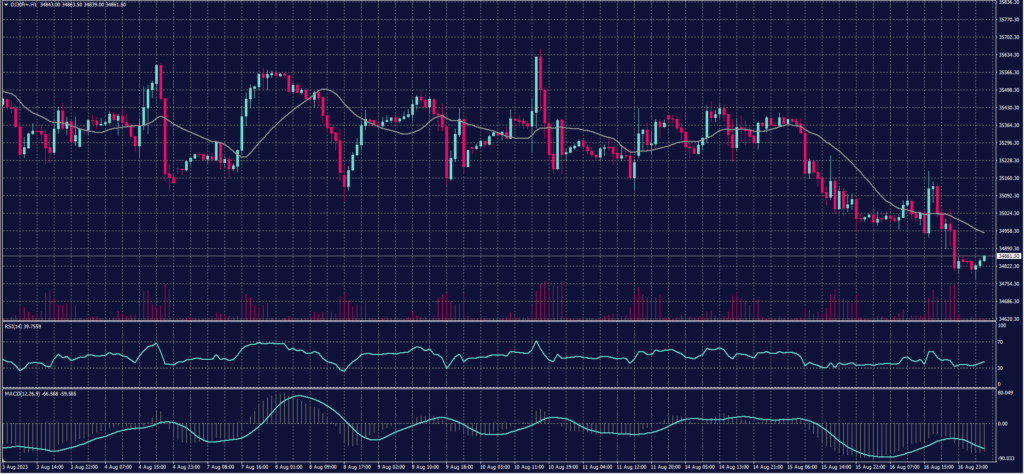

Dow Jones Index (DJ30ft – US30)

On Wednesday, US indices continued their downward trend for the second consecutive day. This decline was driven by investors’ apprehensions regarding the possible extension of elevated interest rates, a sentiment stemming from the disclosure of the US Federal Reserve’s meeting minutes.

The Dow Jones index declined by 0.5%, equivalent to about 180 points, closing at its lowest level in a month. Similarly, the S&P 500 index retreated by 0.75%, pressured by a decline in bank stocks. Bank of America led the losses among major banks.

Pivot point: 34945

| Resistance level | Support level |

| 35085 | 34695 |

| 35330 | 34555 |

| 35470 | 34310 |

US Crude (USOUSD)

Despite a notable decline in US crude oil inventories, oil prices closed lower on Wednesday. Currently, investors are in the midst of evaluating apprehensions linked to China’s weakening economy. In addition, there are expectations of supply shortages in the United States, contributing to the complex market dynamics.

Brent crude futures declined by $1.44 or 1.7% to settle at $83.45 per barrel, while US West Texas Intermediate (WTI) crude dropped by $1.61 or 2% to reach $79.38 per barrel.

Pivot point: 79.90

| Resistance level | Support level |

| 80.75 | 78.40 |

| 82.25 | 77.55 |

| 83.10 | 76.05 |