Markets Are Awaiting US Consumer Price Index Data

Market News Summary

Credit card balances in the US surged in the second quarter, surpassing a trillion dollars for the first time. Americans increasingly turned to their credit cards to cover their expenses as summer approached, leading to a significant increase in total credit card balances, exceeding a trillion dollars for the first time ever. This information was reported by the Federal Reserve Bank of New York yesterday.

European stocks ended Tuesday’s trading session with a decline, as Italian banks were negatively affected by the government’s approval of an unexpected 40% tax on their gains. Despite this, Novo Nordisk pharmaceutical company’s stocks saw a jump after positive data about their obesity treatment drug helped mitigate losses.

Dollar Index (USDX)

The dollar index rose by 0.5%, and markets are now waiting for the US Consumer Price Index data scheduled for release on Thursday. It is likely that inflation in the United States has moderately accelerated in July to 3.3% annually, while the core rate is likely to remain unchanged at 4.8%.

Currently, the dollar is trading near its pivot point at $102.25.

Pivot point: 102.25

| Resistance level | Support level |

| 102.25 | 101.90 |

| 103.00 | 101.50 |

| 103.40 | 101.20 |

Spot Gold (XAUUSD)

On Tuesday, gold prices experienced a decline, edging close to their lowest point in a month. This movement was prompted by investors shifting their focus towards the dollar, a response to the release of underwhelming Chinese trade data. Concurrently, a sense of caution dominated the market atmosphere in anticipation of upcoming U.S. inflation statistics scheduled for later this week.

U.S. gold futures settled down 0.5% at $1,959.9 an ounce. The spot price of gold dropped 0.6% to $1,925.79, after hitting its lowest levels since July 10th.

Pivot point: 1928

| Resistance level | Support level |

| 1934 | 1919 |

| 1943 | 1913 |

| 1949 | 1903 |

Dow Jones Index (DJ30ft – US30)

On Tuesday, U.S. indices closed with collective declines, driven by resurfacing concerns in the financial sector following Moody’s downgrade of several American banks. The credit rating agency lowered the credit ratings of 10 small to medium-sized banks by one notch and placed 6 banks under review for potential downgrades.

The Dow Jones index decreased by 0.45%, equivalent to around 158 points, during Tuesday’s session. This decline came after the index achieved its largest daily gains in 7 weeks during Monday’s session earlier this week.

Pivot point: 35340

| Resistance level | Support level |

| 35605 | 35110 |

| 35830 | 33445 |

| 36100 | 34620 |

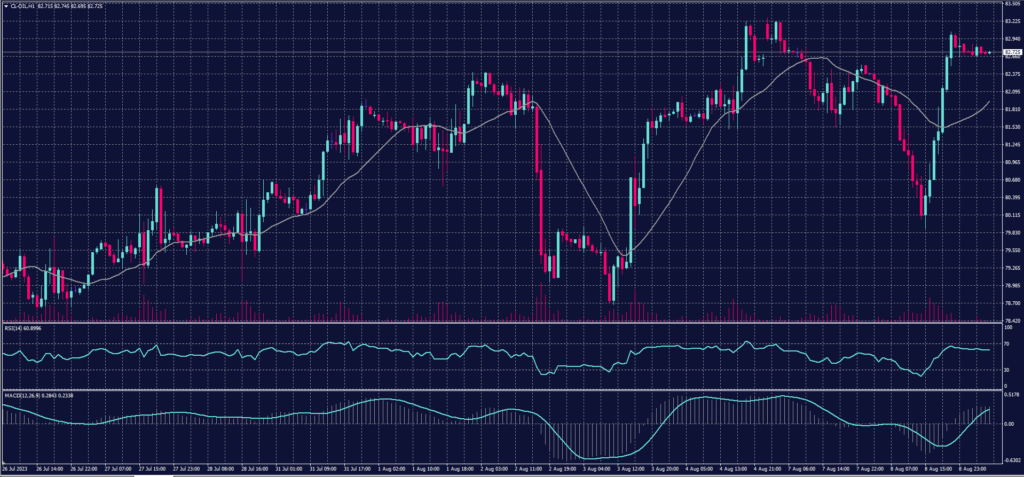

US Crude (USOUSD)

Oil prices rose on Tuesday as a result of a more optimistic outlook projected by a U.S. government agency for the world’s largest economy. However, the impact of China’s decrease in oil imports and exports had an influence on the prices.

Brent crude futures increased by 83 cents to reach $86.17 per barrel at the close. Meanwhile, West Texas Intermediate (WTI) crude, the American benchmark, rose by 98 cents to settle at $82.92 per barrel.

Pivot point: 81.90

| Support level | Resistance level |

| 80.80 | 83.95 |

| 78.75 | 85.05 |

| 77.65 | 87.10 |

Risk Statement

All investments entail risks and can result in both profits and losses. Leveraged products, in particular, may not be appropriate for all investors as the effect of leverage is that both gains and losses are magnified. Before deciding to invest in any financial product, you should carefully consider your investment objectives, financial knowledge and experience and affordability as the prices of leveraged products may change to your disadvantage very quickly, it is possible for you to lose more than your invested capital and you may be required to make further payments.