Gold Hits Three-Week High on Zero-Yield Alloy Rush Amidst U.S. Rate Cuts

Market News Summary

Industrial production in Japan declined in November amid a decrease in car production and uncertainty about export-dependent economic expectations. According to data released on Thursday, December 28, by the Japanese Ministry of Economy, Trade, and Industry, industrial production fell by about 0.9% in November on a monthly basis, which is a better performance than the expected decline of about 1.6%.

The Spanish government has opted to prolong several measures, notably the reduction of taxes on essential food items, initially introduced to shield families from the escalating cost of living. This decision persists even in light of a recent downturn in the inflation rate. During a press conference held in Madrid on Wednesday, Prime Minister Pedro Sanchez announced that the value-added tax on specific fundamental food products will maintain a 0% rate throughout the initial half of 2024.

Dollar Index (USDX)

The Federal Reserve is set to commence the new year with fresh evidence indicating a significant decline in price pressures in the United States. The data from last week marks the first time since March 2021 that the annual Consumer Price Index has been below 3%, signaling a robust reduction.

The cold inflation figures have bolstered expectations of an interest rate cut by the Federal Reserve in March. Traders now anticipate this move with an approximate 90% probability, according to the CME FedWatch tool.

Pivot point: 100.75

| Resistance level | Support level |

| 101.05 | 100.30 |

| 101.45 | 100.05 |

| 101.70 | 99.60 |

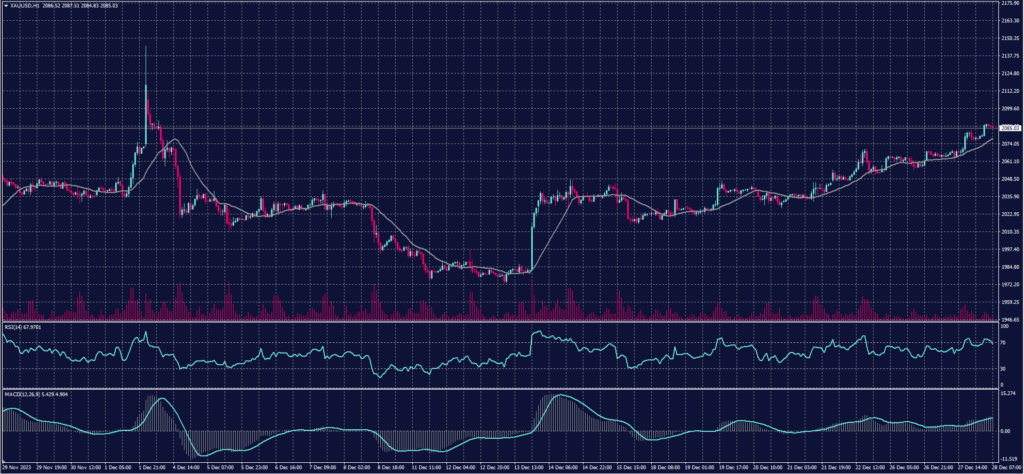

Spot Gold (XAUUSD)

Gold rose to its highest levels in three weeks as traders rushed to buy zero-yield alloys in anticipation of a potential cut in U.S. interest rates next year. The decline in the dollar and bond yields also supported prices.

The spot price of gold increased by 0.5% to $2,076.45 per ounce, reaching its highest level since December 4th. It is on track to achieve nearly a 14% gain in 2023 if the current momentum continues. The settlement price in U.S. gold futures rose by 1.1% to $2,093.10.

Pivot point: 2074

| Resistance level | Support level |

| 2087 | 2064 |

| 2097 | 2051 |

| 2110 | 2041 |

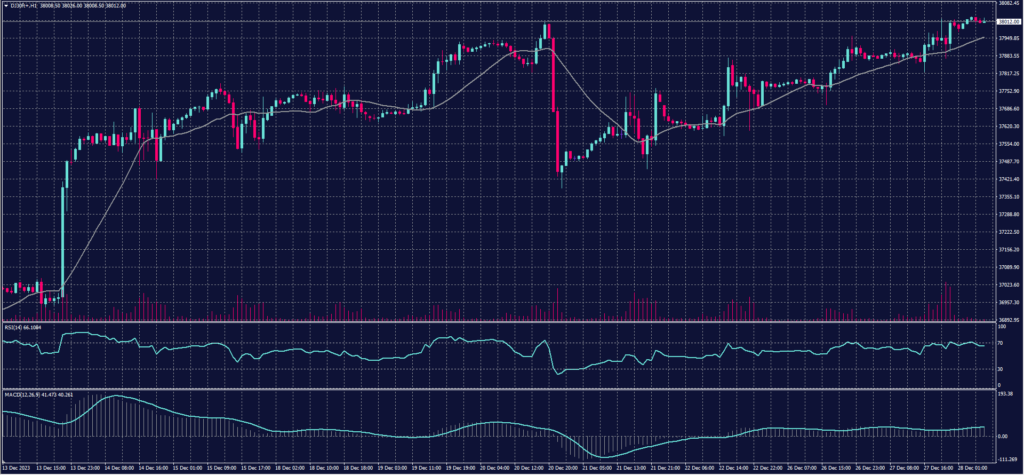

Dow Jones Index (DJ30ft – US30)

The futures contracts for the Standard & Poor’s 500 index neared stability on Wednesday night, as the benchmark index closed at an all-time high. The futures contracts linked to the Nasdaq 100 index changed only slightly. Futures for the Dow Jones Industrial Average fell by 8 points, also remaining close to stability.

These movements followed a slight uptick on Wall Street, where the S&P 500 index finished the session with a 0.1% gain, approaching record levels. The Nasdaq Composite index added nearly 0.2% during the session, while the Dow Jones Industrial Average, comprising 30 stocks, concluded with a 0.3% increase.

Pivot point: 37950

| Resistance level | Support level |

| 38075 | 37875 |

| 38150 | 37750 |

| 38270 | 37675 |

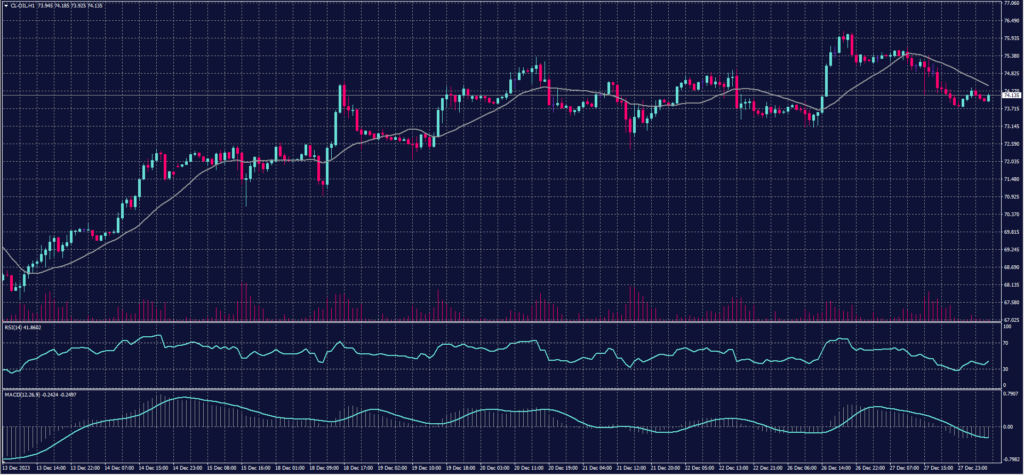

US Crude Oil (USOUSD)

Oil prices declined by 2% yesterday, erasing the gains from the previous day as investors monitored developments in the Red Sea. Some major shipping companies resumed passage through the region despite new attacks that occurred last Tuesday.

Brent crude futures dropped by $1.42, or 1.8%, settling at $79.65 per barrel. Similarly, West Texas Intermediate (WTI) crude, the American benchmark, fell by $1.46, or 1.9%, closing at $74.11 per barrel.

Pivot point: 74.40

| Resistance level | Support level |

| 75.05 | 73.15 |

| 76.30 | 72.50 |

| 76.90 | 71.30 |

Risk Warning

This article provides real-time market analysis from contributing analysts. Please note that any views expressed in this article do not constitute operational advice. It is important to assess your risk tolerance and make independent trading decisions. STARTRADER holds no responsibility for any trading consequences that may arise from relying on the views expressed in this article.