Oil Continues to Rise Amid Geopolitical Risks

Market News Summary

Recently, leaders of the U.S. Congress reached an agreement on the ‘total spending,’ as announced by the Speaker of the House on Sunday, January 7th. The U.S. House Speaker, Mike Johnson, stated that the top leaders of Congress agreed on a total federal spending level of 1.6 trillion dollars with the aim of avoiding a partial government shutdown later in the month. Johnson added in a message to legislators on Sunday that the total amount includes 886 billion dollars for defense spending and 704 billion dollars for non-defense spending.

Bank of America believes that the sharp increase in NVidia’s stock price recorded in 2023 is expected to continue this year. The bank notes that the company continues to benefit from its success in developing and selling artificial intelligence chips. According to the American bank’s memo, the rapid growth of earnings and revenues for NVidia will allow it to achieve free cash flows of 100 billion dollars over the next two years. The company had generated free cash flows of less than 30 billion dollars over the past two years.

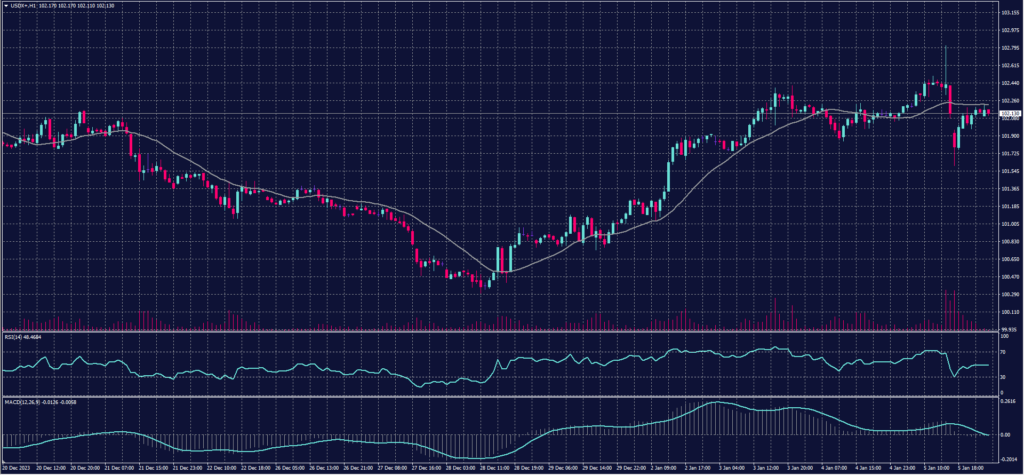

Dollar Index (USDX)

The official data revealed that employers in the United States hired a greater number of workers in December than expected. However, separate data from the Institute for Supply Management (ISM) indicated a significant slowdown in the U.S. service sector last month.

Nonfarm payroll data turned out stronger than anticipated, leading to some pressure on the markets. Nevertheless, some ISM data was weaker than expected, resulting in a shift in trends.

Pivot Point: 102.20

| Resistance level | Support level |

| 102.75 | 101.55 |

| 103.40 | 100.95 |

| 103.95 | 100.35 |

Spot Gold (XAUUSD)

Gold stabilized on Friday after fluctuating by a percentage point due to mixed U.S. economic data. However, the metal recorded its first weekly decline in four weeks, influenced by a general rise in the dollar and an increase in Treasury bond yields.

Gold in spot transactions rose by 0.1% to $2,044.21 per ounce, recovering from a 1% decline earlier in the last sessions of the past week.

Pivot Point: 2044

| Resistance level | Support level |

| 2064 | 2033 |

| 2084 | 2025 |

| 2104 | 2004 |

Dow Jones Index (DJ30ft – US30)

The futures contracts for U.S. stocks showed limited changes at the beginning of the week after the S&P 500 index ended a nine-week winning streak.

Futures for the Dow Jones index dropped by 38 points or 0.1%. Meanwhile, the futures for the S&P 500 and Nasdaq indices rose by 0.02% and 0.05%, respectively.

Pivot Point: 37695

| Resistance level | Support level |

| 37890 | 37515 |

| 38075 | 37320 |

| 38265 | 37140 |

US Crude Oil (USOUSD)

Oil prices concluded the first week of 2024 in the green zone, in parallel with tensions in the Middle East and escalating risks in the Red Sea due to attacks targeting commercial ships.

Brent crude futures rose by 1.51% at settlement, reaching $78.76 per barrel and securing a weekly gain of 2.23%. Meanwhile, West Texas Intermediate (WTI) crude futures increased by 2.24% at settlement, reaching $73.81 per barrel and achieving a weekly gain of 3%.

Pivot Point: 73.45

| Resistance level | Support level |

| 74.65 | 72.60 |

| 75.45 | 71.40 |

| 76.65 | 70.75 |

Risk Warning

This article provides real-time market analysis from contributing analysts. Please note that any views expressed in this article do not constitute operational advice. It is important to assess your risk tolerance and make independent trading decisions. STARTRADER holds no responsibility for any trading consequences that may arise from relying on the views expressed in this article.