Oil Prices Are Falling, And the Dollar Is Trying to Stabilize

Market News Summary

After European stocks recorded their biggest weekly jump in about 7 months last week, they fell as Monday’s trading closed following weak data. This decline occurred amid a drop in the real estate sector despite the gains of Ryanair. The European Stoxx 600 index closed down 0.2% after jumping more than 3% last week. Investors were celebrating a series of strong earnings and indications that major central banks were nearing the end of tightening their monetary policy.

Microsoft’s stock rose more than 1% on Monday, reaching its highest level in about four months. The company added $28 billion to its market value in a single day.

Dollar Index (USDX)

The prices of the dollar index have fluctuated since yesterday, reaching levels of $104.60 before returning today to trade above its pivotal point at $105.20. Meanwhile, the yields of the benchmark 10-year US Treasury bonds increased as investors remained attentive to at least nine Federal Reserve members scheduled to speak this week, including Powell on November 9.

Traders anticipate that the Federal Reserve will likely leave interest rates unchanged in December, with a probability of 90%.

Pivot Point: 104.95

| Resistance level | Support level |

| 105.25 | 104.80 |

| 105.40 | 104.50 |

| 105.60 | 104.35 |

Spot Gold (XAUUSD)

Yesterday, on Monday, gold prices fell as the yields on US Treasury bonds increased. Investors remained cautious as they prepared to hear from speakers representing the Federal Reserve this week, including Jerome Powell, seeking clarification on potential US interest rate cuts.

The spot price of gold dropped by 0.7% to $1,979.19 per ounce after rising above the key level of $2,000 on Friday. US gold futures settled down by 0.5% at $1,988.60.

Gold is currently trading below its pivotal point at $1,971 per ounce.

Pivot Point: 1972

| Resistance level | Support level |

| 1982 | 1972 |

| 1987 | 1966 |

| 1998 | 1956 |

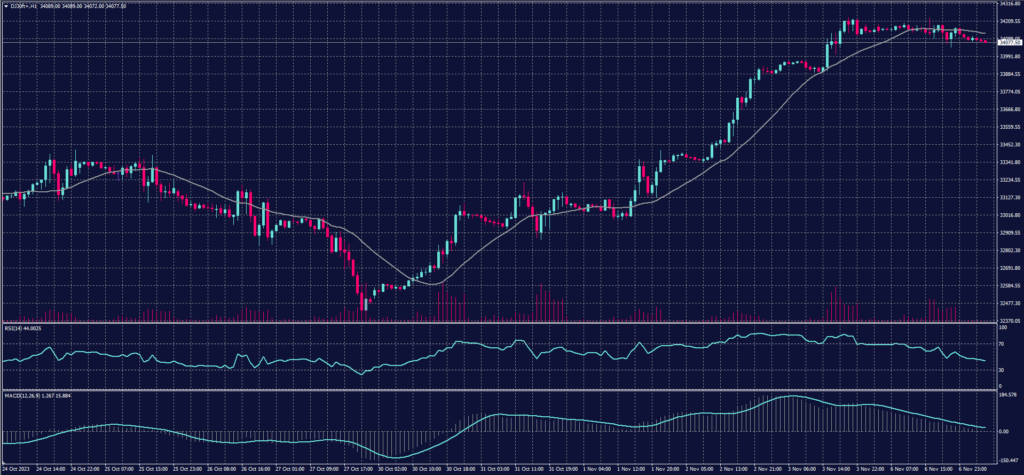

Dow Jones Index (DJ30ft – US30)

The US stock indices closed with slight gains on Monday as investors awaited statements from a group of policymakers at the Federal Reserve this week, including Jerome Powell, to understand the trajectory of monetary policy in the United States. Investors are also anticipating several major corporate earnings reports this week, including those from Walt Disney and Instacart.

The Dow Jones Industrial Average rose by 0.1%, equivalent to a 34-point increase, marking its sixth consecutive session of gains and achieving its highest daily close in about 7 weeks. The Nasdaq Composite increased by 0.3%, marking its seventh consecutive session of gains and achieving its highest daily close in approximately 3 weeks. Additionally, the S&P 500 rose by 0.2%, also marking its sixth consecutive session of gains and achieving its highest daily close in about 3 weeks.

Pivot Point: 34135

| Resistance level | Support level |

| 34220 | 34040 |

| 34315 | 33950 |

| 34395 | 33865 |

US Crude Oil (USOUSD)

On Monday, oil prices rose after Saudi Arabia and Russia, the two largest oil suppliers, confirmed their commitment to additional voluntary oil supply cuts until the end of the year.

Brent crude futures rose by 29 cents, or 0.34%, to $85.18 per barrel at the settlement. Additionally, West Texas Intermediate (WTI) crude futures settled higher by around 31 cents, or 0.39%, at $80.82 per barrel.

Pivot Point: 81.25

| Resistance level | Support level |

| 81.85 | 80.30 |

| 82.80 | 79.65 |

| 83.45 | 78.70 |

Risk Warning

This article provides real-time market analysis from contributing analysts. Please note that any views expressed in this article do not constitute operational advice. It is important to assess your risk tolerance and make independent trading decisions. STARTRADER holds no responsibility for any trading consequences that may arise from relying on the views expressed in this article.