The Nasdaq Composite Index Fell from Its Highest Levels in 4 Months

Market News Summary

European stock indices closed slightly lower yesterday as investors remained in a wait-and-see mode, anticipating the monetary policies of central banks. This anticipation was coupled with expectations regarding the minutes of the Federal Reserve meeting. The Stoxx 600 index closed down by 0.1% after a quiet trading day, marking the end of the third-quarter earnings season. Retail stocks led gains, rising by 0.7%, while automotive stocks declined by 1.6%.

The minutes of the Federal Reserve meeting (October 31 – November 1) indicated that officials did not show any inclination towards an imminent interest rate cut, especially considering that inflation remains above the target.

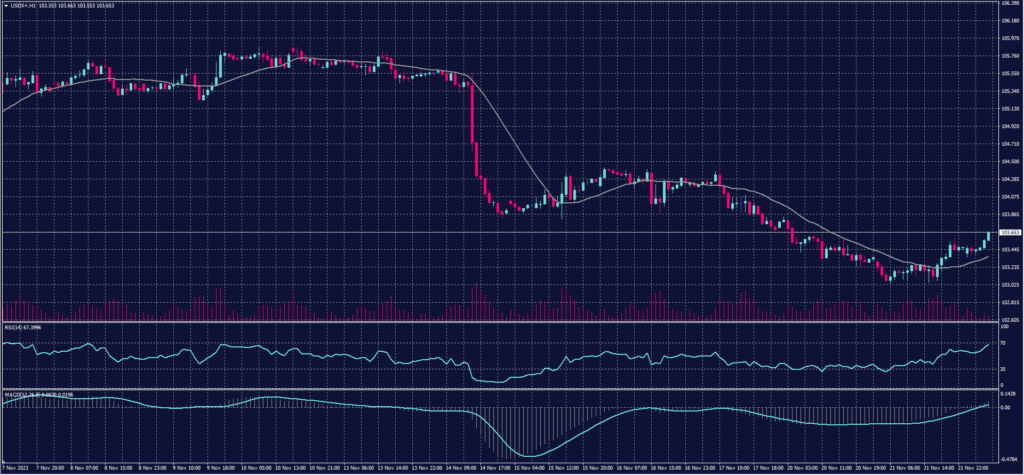

Dollar Index (USDX)

The dollar held steady against other major currencies after declining to its lowest levels in two and a half months in the previous session. Officials at the Federal Reserve, in their recent policy meeting, agreed to proceed cautiously and only raise interest rates if progress in curbing inflation falters.

The dollar is currently trading above its pivotal point at $103.65.

Pivot Point: 103.35

| Resistance level | Support level |

| 103.65 | 103.15 |

| 103.90 | 102.85 |

| 104.20 | 102.60 |

Spot Gold (XAUUSD)

On Wednesday, gold prices dipped to below $2,000 as the dollar stabilized following its recent decline. However, expectations that the Federal Reserve has reached the end of its tightening cycle tempered the downward pressure on gold prices.

Gold in spot trading decreased by 0.1% to $1,996.79 per ounce after reaching its highest levels in three weeks in the previous session at $2,007.29. U.S. gold futures also declined by 0.1% to $1,998.80.

Pivot Point: 1994

| Resistance level | Support level |

| 2011 | 1981 |

| 2024 | 1964 |

| 2041 | 1951 |

Dow Jones Index (DJ30ft – US30)

U.S. indices closed with collective losses on Tuesday after the Federal Reserve meeting minutes revealed that officials did not show any inclination towards an imminent interest rate cut, particularly since inflation remains above the targeted levels. The minutes also indicated that they would only consider raising interest rates if the information available showed a lack of progress in curbing inflation.

The Dow Jones index declined by about 0.2%, equivalent to 63 points, falling from its highest level in three months. The Nasdaq index dropped by 0.6%, retreating from its highest level in about 4 months, while the S&P 500 index decreased by around 0.2% after five consecutive sessions of gains, influenced by pressure on retail and technology stocks.

Pivot Point: 35160

| Resistance level | Support level |

| 35225 | 35075 |

| 35310 | 35010 |

| 35375 | 34925 |

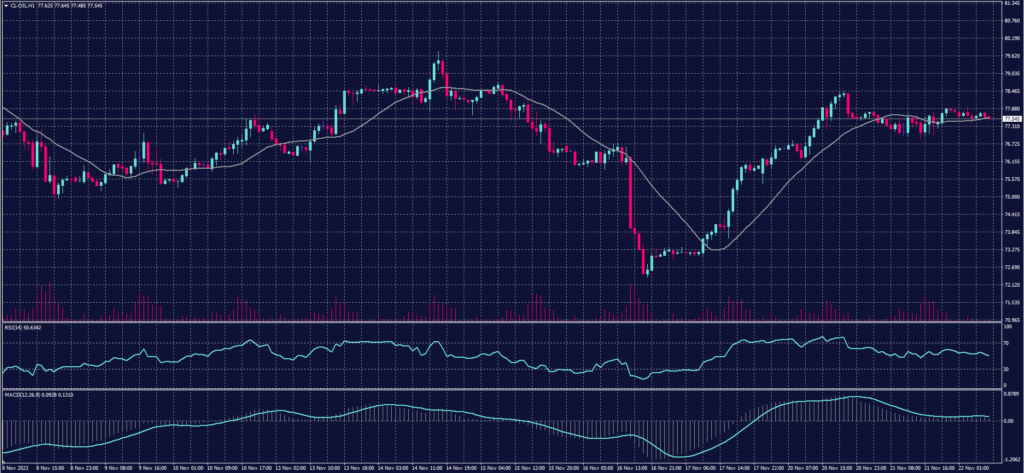

US Crude Oil (USOUSD)

Oil prices diverged at the close on Tuesday as investors exercised caution ahead of the upcoming OPEC+ meeting next Sunday. The meeting may discuss increasing supply cuts due to the global economic slowdown.

Brent crude futures rose by 13 cents to settle at $82.45 per barrel, while West Texas Intermediate (WTI) crude futures, the U.S. benchmark, fell by six cents to $77.77 per barrel.

Pivot Point: 77.55

| Resistance level | Support level |

| 78.15 | 77.15 |

| 78.50 | 76.55 |

| 79.15 | 76.20 |

Risk Warning

This article provides real-time market analysis from contributing analysts. Please note that any views expressed in this article do not constitute operational advice. It is important to assess your risk tolerance and make independent trading decisions. STARTRADER holds no responsibility for any trading consequences that may arise from relying on the views expressed in this article.