The S&P 500 Index Is 13 Points Away from Its All-Time High

Market News Summary

The STOXX600 European index closed approximately 0.17% in Wednesday’s session on January 10, as negative sentiments returned to the markets. Mining stocks remained among the worst performers this week, declining by 1.07%, while media stocks increased by 0.75%.

On Wall Street, Meta’s stock jumped by 3.6% in Wednesday’s session, reaching its highest level in 28 months. The company added $33 billion to its market value in a single day. These gains followed Mizuho Securities raising its target price for Meta’s stock to $470 from $400.

Dollar Index (USDX)

The dollar index declined by 0.1% for the second consecutive session, currently trading below its pivot point at $101.95. Investors are awaiting today’s consumer price index data to understand the Federal Reserve’s plan and hints about the future interest rate trajectory.

Pivot Point: 102.15

| Resistance level | Support level |

| 102.25 | 101.95 |

| 102.45 | 101.80 |

| 102.55 | 101.65 |

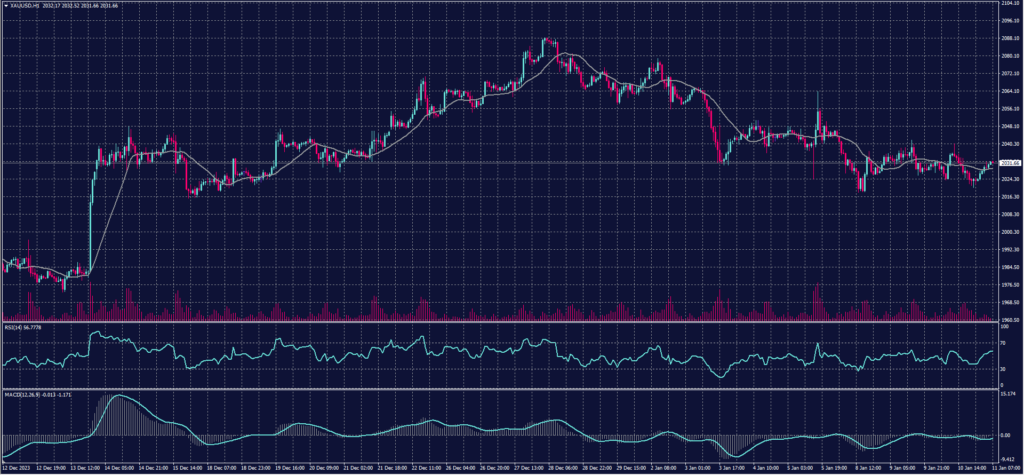

Spot Gold (XAUUSD)

On Thursday, January 11, gold prices rose, while the dollar continued its decline ahead of inflation data in the United States. The upcoming data is expected to provide further insights into the potential monetary policy path that the Federal Reserve may take throughout the year.

Gold in spot transactions increased by 0.3% to $2028.78 per ounce, and gold futures rose by 0.3% to $2033.00.

Pivot Point: 2028

| Resistance level | Support level |

| 2036 | 2016 |

| 2048 | 2008 |

| 2055 | 1996 |

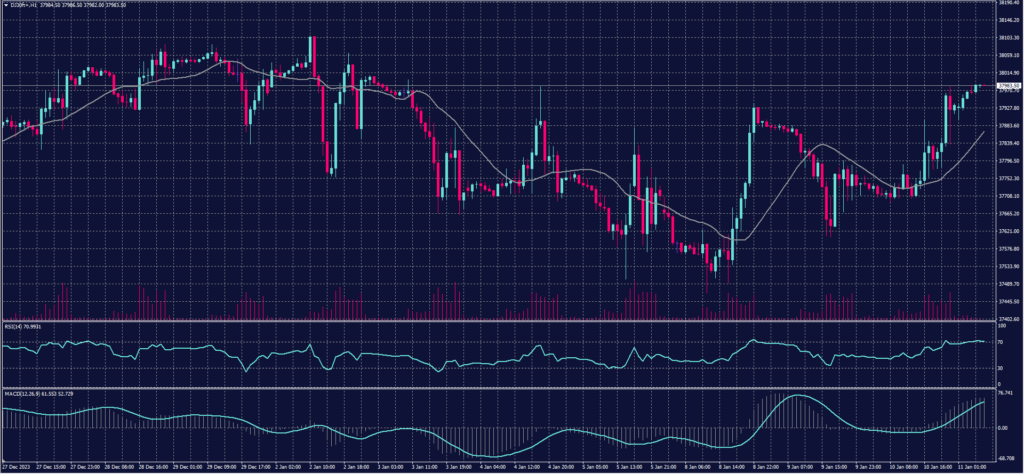

Dow Jones Index (DJ30ft – US30)

The primary US indices concluded Wednesday’s session with collective gains, propelled by the strength of major technology stocks. Investors are awaiting inflation data and the upcoming financial reports from leading banks later in the week. On Friday, JPMorgan Chase, Bank of America, Citigroup, and Wells Fargo are anticipated to announce a decline in fourth-quarter profits.

The Dow Jones index posted a 0.45% gain, equivalent to 170 points on Wednesday’s session, marking its highest close in a week. The S&P 500 also showed a 0.57% increase, bringing it within 0.27% or 13 points of its record closing at 4796.56, recorded on January 3, 2022. Simultaneously, the Nasdaq Composite rose by approximately 0.75%, achieving its fourth consecutive daily gain.

Pivot Point: 37870

| Resistance level | Support level |

| 38045 | 37760 |

| 38155 | 37585 |

| 38330 | 37475 |

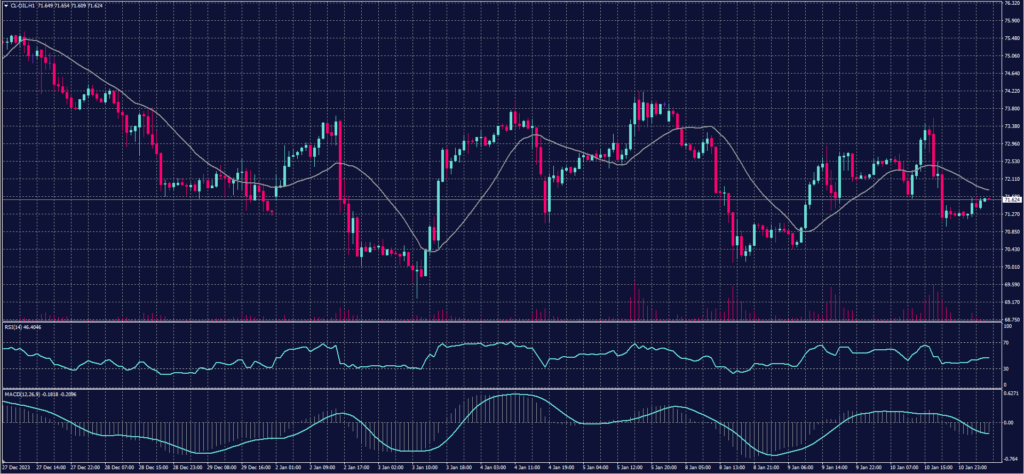

US Crude Oil (USOUSD)

Oil prices rose during Thursday’s trading on January 11, rebounding from Wednesday’s decline influenced by a surprising increase in US crude inventories. The market also remained attentive to escalating tensions in the Middle East.

Yesterday, data from the US Energy Information Administration revealed a rise in American crude inventories by approximately 1.3 million barrels for the week ending on January 5, reaching 432.4 million barrels. This contrasted with analysts’ expectations of a decrease by 700,000 barrels.

Pivot Point: 71.95

| Resistance level | Support level |

| 72.90 | 70.35 |

| 74.50 | 69.35 |

| 75.50 | 67.75 |

Risk Warning

This article provides real-time market analysis from contributing analysts. Please note that any views expressed in this article do not constitute operational advice. It is important to assess your risk tolerance and make independent trading decisions. STARTRADER holds no responsibility for any trading consequences that may arise from relying on the views expressed in this article.