U.S. Data Shows Resilience But The Greenback Remains Weak

U.S. Dollar Index (USDX)

The U.S. dollar held firm this morning, following its biggest rally in two weeks amid the solid services data in the United States. However, the U.S. dollar index switched hands at 105.11 in the early Asian session, easing 0.1% after Monday’s 0.7% rally. It had dipped to 104.1 for the first time since June 28 as traders continued to rein in bets of aggressive Fed tightening.

Yet, the index reversed course as the Institute for Supply Management’s (ISM) non-manufacturing PMI unexpectedly rose, indicating the services sector, which accounts for more than two-thirds of U.S. economic activity, remained resilient.

On the hourly chart, the index broke below the critical support at 105.25 which led the chart to 104. However, the index does not have major support above 103.40 and 102.60. On the other hand, the daily chart shows a high probability to trade between 103.40 and 102.60.

Technical indicators show a speculative trend around the current levels while confirming the daily chart decline.

Pivot Point: 105.10

| SUPPORT | RESISTANCE |

| 104.30 | 105.25 |

| 103.40 | 105.90 |

| 102.60 | 106.30 |

Australian Dollar (AUDUSD)

The Australian dollar weakened to near a one-week low ahead of a looming central bank rate decision, with market participants watching for signs of a pause in tightening after inflation unexpectedly cooled last month.

Although economists expect the Reserve Bank of Australia to raise the key rate by a quarter point, the focus will be on clues from the policy statement on the outlook for the following meeting in February. Meanwhile, the Aussie dollar rose 0.21% to $0.6713, clawing back some of a 1.4% overnight tumble.

Pivot Point: 0.6725

| SUPPORT | RESISTANCE |

| 0.6690 | 0.6735 |

| 0.6670 | 0.6755 |

| 0.6635 | 0.6770 |

Spot Gold (XAUUSD)

Gold prices dropped below key levels this morning, with metal markets back under pressure as stronger-than-expected U.S. data boosted the dollar and ramped up uncertainty over strength in the U.S. economy and how the Federal Reserve will respond to it.

While the Fed has mentioned hikes in the coming meetings, it also warned that rates could peak at higher-than-expected levels. Spot gold traded around $1,769.30 an ounce for the majority of the early sessions, while gold futures were steady at $1,781.55 an ounce.

The 4 hours and the daily chart show a high probability of continuing the uptrend despite the readings of the technical indicators. However, RSI and MACD show a probability of a slight drop to $1,765 per ounce.

Pivot Point: $1,770

| SUPPORT | RESISTANCE |

| 1,765 | 1,785 |

| 1,760 | 1,790 |

| 1,755 | 1,795 |

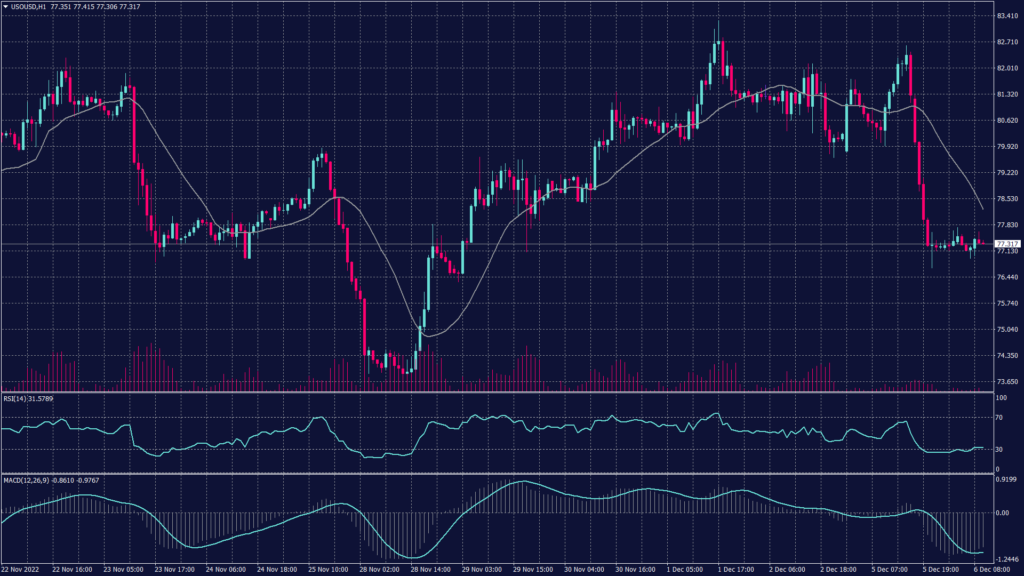

West Texas Crude (USOUSD)

Oil prices rose on Tuesday as sharp losses in the prior session tempted some bargain buying and as markets bet on a recovery in Chinese demand, although concerns over rising U.S. interest rates kept investors on edge.

Oil markets were under selling pressure during the last trading session after stronger-than-expected U.S. economic data ramped up fears of persistent inflationary pressures. Brent oil futures rose 0.3% to $83.28 a barrel, while West Texas Intermediate crude futures rose 0.8% to $77.58 a barrel.

Pivot Point: 77.25

| SUPPORT | RESISTANCE |

| 76.10 | 78.50 |

| 74.40 | 79.70 |

| 73.80 | 80.50 |